Incorporate your Business & Save Tax!

Do you currently own your own business and are thinking about incorporating? There are many advantages to incorporation especially in Canada. The first advantage to incorporating your business is limiting your personal risk at a very low tax rate of only 15%. As a result of becoming a limited liability corporation, you are no longer personally responsible for business debts of the corporation. Furthermore, incorporating can also allow for things like government grants, and other possible tax advantages. Small Canadian controlled private corporations (CCPC’s) are subject to considerable tax breaks. CCPC’s are taxed at about half of the regular rate on the first $500,000 of active business income in each year.

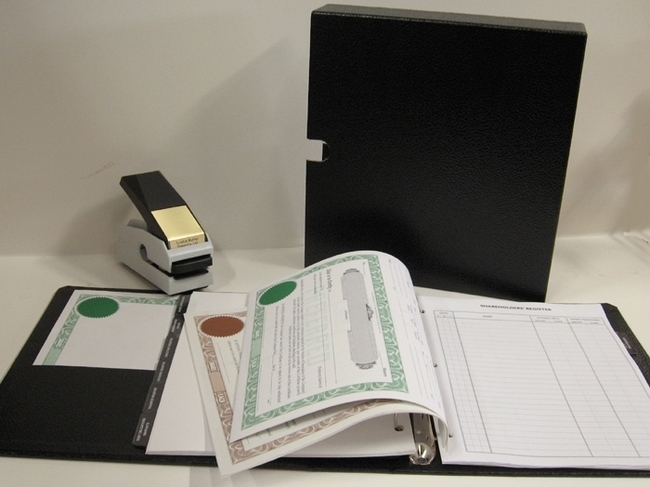

Birdi CPA can help to ease the transition of your business to a corporation through our incorporation services. First of all we can ensure your dealings with the CRA go as smoothly as possible. Additionally, we will help you form your corporation strategically for tax purposes and prepare your minute books. Finally, Birdi CPA will walk you through an in-depth meeting on how to operate your corporation and create a custom tax plan for you.

Free Consultation

At Birdi CPA we strongly believe that the customer comes first. Therefore we offer a free consultation to all potential clients. Feel free to ask us questions that you have about incorporating your business as we believe that it can be very advantageous for your business. Just give us a call or contact us through our website to book your free consultation because we want to help your business succeed.