A Powerful Tax Saving Tool!

Business owners of all industries use a family trust to take advantage of a number of financial and tax saving strategies such as:

- Income-split with family members

- Multiply the Life-Time Capital Gains Exemption

- Creditor Proof assets

- Estate and Succession Plan

- Secure a loved one who has a disability

Due to growing popularity, the Canadian Revenue Agency has put these trusts under the microscope. Unfortunately, very few business owners fully understand how discretionary and personal trusts work or the steps it takes in order to structure one. Furthermore, a business owner must ensure that their family trust is properly established. If not, their business may be subject to a penalty.

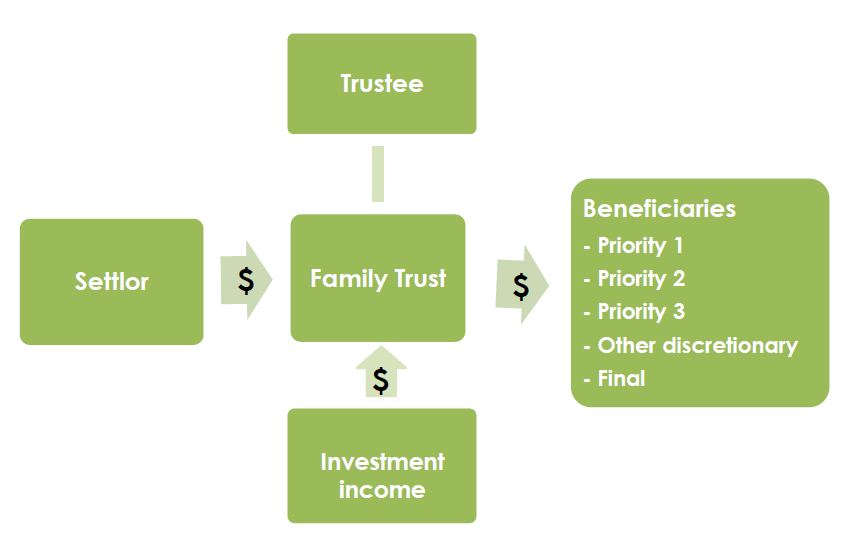

Birdi CPA is able to offer a variety of services to arrange a valid family trust for your business. Starting off, our team will determine if a family trust meets your objectives and how it can save you taxes. We will work with your legal counsel to properly construct the family trust deed. Additionally, our staff will assist you in identifying the exact details in regards to the beneficiaries, settlor and trustees’ of the your trust. Lastly, we will explain how to maintain and operate the trust through a tax planning meeting.

Free Consultation

At Birdi CPA we strongly believe that the customer comes first. Therefore we offer a consultation at no cost to all businesses. Feel free to ask us any questions that you have about family trust planning and whether its right for you. If you already have a trust in place, have Birdi CPA review your tax structure to ensure you are using it strategically. Just give us a call or contact us through our website to book your free consultation because we want to help your business succeed.